Over the years, we have found that many of our hard-working clients have a SKU assortment that is unfortunately not aligned with optimizing portfolio profitability.

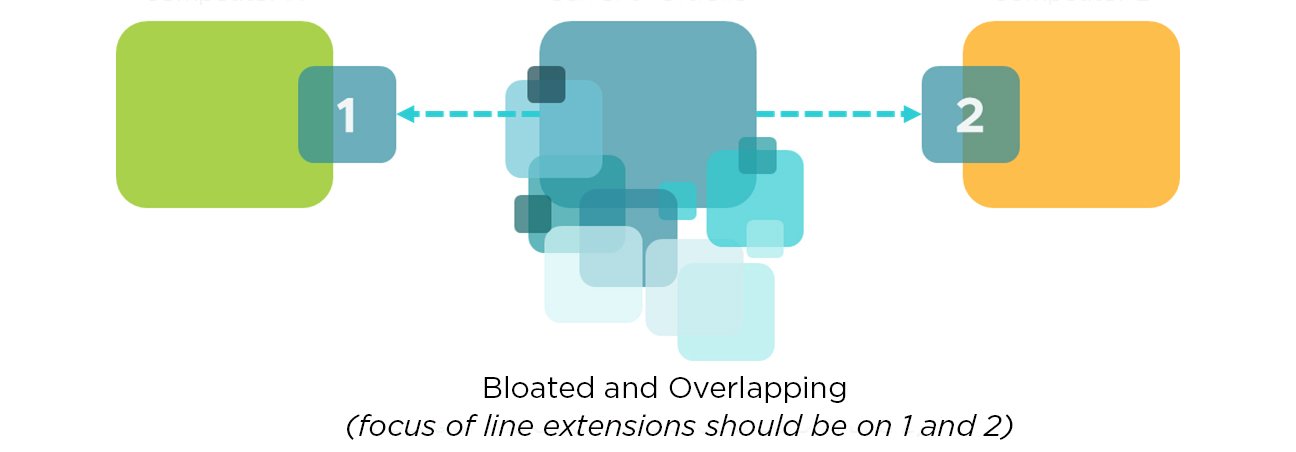

In fact, it is rare to encounter clients that have an intentional, consistent, and effective process for managing their SKU assortment in terms of which items to keep, which to delist and which to add (through true innovation, acquisition, or line extension).

There is a great HBR article called Extend Profits, Not Product Lines by John Quelch and David Kenny from 30 years ago that preached the importance of extending profits rather than profit lines.

The authors laid out many challenges, distractions, limitations, competing internal incentives, unaligned priorities, retailer pressures and supply chain challenges that keep companies from getting their SKU mix right from a profitability perspective.

This HBR article would still be amazingly salient if it were to be published today. The same SKU assortment challenges are still commonly seen 30 years later, despite…

- vast improvements in data availability, analytics, and computing power

- the rise of Revenue Growth Management roles across companies

- increased pressure from Wall Street, private equity, and activist investors

We have all heard the warning of “don’t reinvent the wheel.” Yep, got it. Many of us have also heard the counter-phrase of “don’t replicate a flat tire.” Each fiscal quarter that a SKU assortment mix remains unchallenged represents a de facto decision to forego increased profitability. That upsets us.

I’m guessing most readers would prefer to make $100 million profit on the right mix of 40 SKUs rather than $30 million profit on an assortment of 120 SKUs. More SKUs is NOT better than fewer SKUs. Yes, you can still defend your shelf footage with fewer SKUs.

Yes, you can still create interest in the shopping aisle with fewer SKUs. And yes, you can avoid costs, resources and managerial attention being misdirected to the wrong SKUs when you have intentionally landed on the best mix of SKUs.

In future posts, we will go deeper into why most companies still have not cracked the SKU assortment challenge. For now, we want to share some preventive medicine for those companies that want to intentionally pursue strategic simplicity.

It is common to see brand, sales or finance folks simply rank all portfolio SKUs by sales and just cut the bottom X% (often referred to as “cutting the tail”). While simple and intuitive, this is also likely to be a mistake for a few reasons, including:

- the importance of knowing (or predicting) transferred demand. Would current buyers of delisting SKU candidate X be likely to substitute with another SKU that will be retained in the portfolio? Pruning portfolio-cannibalizing SKUs should first entail knowing the degree of transferred demand for these cut candidates.

- There may be SKUs that have some form of “diplomatic immunity” in your portfolio and therefore may be harder to cut. Examples of such “immune” SKUs could be channel or retailer-specific items, e.g., SKUs designed specifically for Dollar Channel, SKUs sold only in Walmart, etc. In time, even these types of SKUs may be cuttable, however, they may survive the initial assortment pruning.

- Cost of goods, inventory and other margin considerations likely differ by SKU. This can result in a SKU with sales in the bottom portion of the ranking actual contributing higher profits than a better selling (units or volume) SKU.

- Many lower performing SKUs simply have not been given enough time or support to get the kind of traction they could achieve.

The latest Circana/IRI report on New Product Pacesetters 2023 makes a great point that essential trial and repeat purchases often happens in year two (while year one is often focused on distribution and awareness building).

Proper SKU assortment optimization is hardest the first time you do it. It tends to be cross-functional in nature and getting the right data in the right form in the right hands may take time to sort out initially. However, the benefits are certainly worth the effort. Plus, it gets easier and quicker over time.

We believe in the power of deep and wide marketing experience blended with the right analytical approaches. We love creating data-informed stories that respect the realities of our client’s operations and those of their distribution and retail partners.

To overcome the limitations of ivory tower models and data science operations that lack the practitioners’ lenses, Middlegame has developed our Competitive Interactions Analysis (CIA)® approach that is well suited for SKU assortment optimization.

We also have vast experience in supporting and informing internal client conversations that can bring the benefits of SKU assortment optimization to life. We figure the more we can help you to increase your profitability, the more we will get invited back to help again.

Gotta love win/win capitalism.

Middlegame is the only ROMI consultancy of its kind that offers a holistic view of the implications of re-source allocation and investment in the marketplace. Our approach to scenario-planning differs from other marketing analytics providers by addressing the anticipated outcome for every SKU (your portfolio and your competitors) in every channel. Similar to the pieces in chess, each stakeholder can now evaluate the trade-offs of potential choices and collectively apply them to create win-win results.

Contact us at middlegame.com