Providing the Best Diapers Pour les Bébés

LOCATION: France

A paper manufacturer who sells baby diapers sought to reallocate merchandising events within a portfolio to create a win-win result for retailers while prioritizing conversations with buyers at those organizations.

SITUATION REVIEW

Invigorating Diaper Sales in France

The paper manufacturer sold baby diapers across three different brands – premium, mainstream, and value – in France. The results for 2016 were not as strong as expected across their three main hypermarket partners. A full assessment of the assortment, pricing and merchandising support was leveraged to reinvigorate these retailers. Middlegame supplied the predictive analytics to support the trade-off analysis of alternatives.

OPPORTUNITY ASSESSMENT

The Pros and Cons of Each Diaper Brand

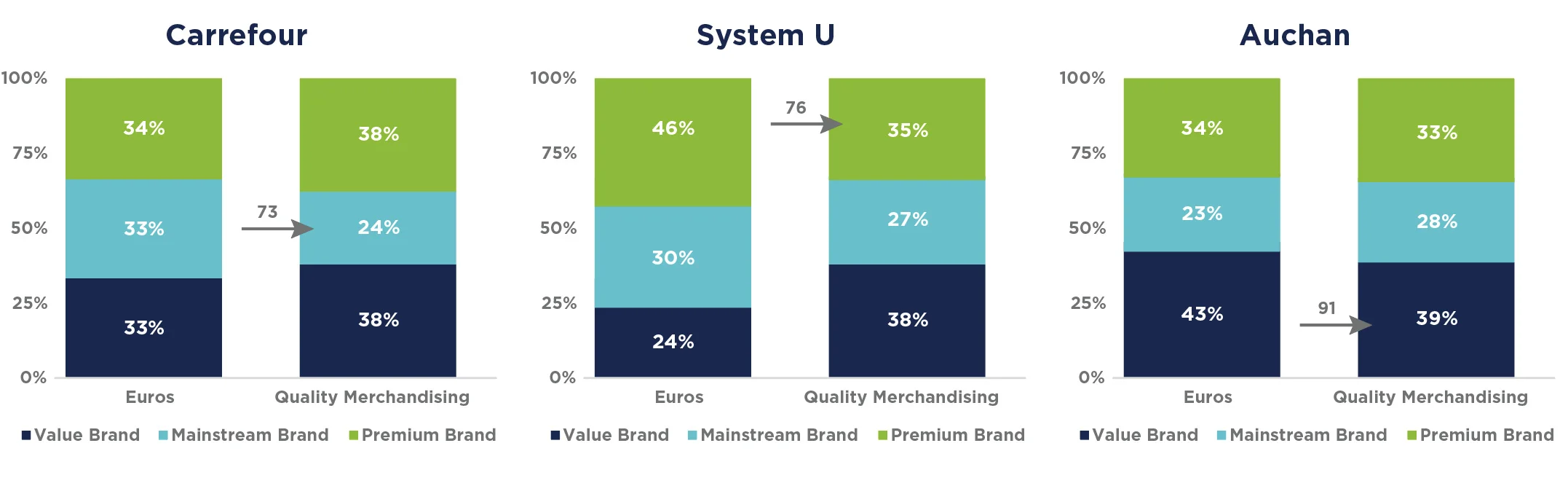

A review of SKU-level merchandising support highlighted how important quality events were to portfolio success in this channel. Price promotions were supported by both leaflets and merchandising displays. In Carrefour stores, the mainstream brand was under-indexing in terms of the share of quality merchandising support to euros generated (73 Index). At System U, the premium brand was a victim of the same problem where the share of events was also significantly less than the share of euro sales (76 Index). The value brand was the underdeveloped player at Auchan (91 Index), but this was slightly expected. Further developing the value brand would be tough given the presence of private label (the store brands).

SCENARIO DEFINITION

Generating a Win-Win Story

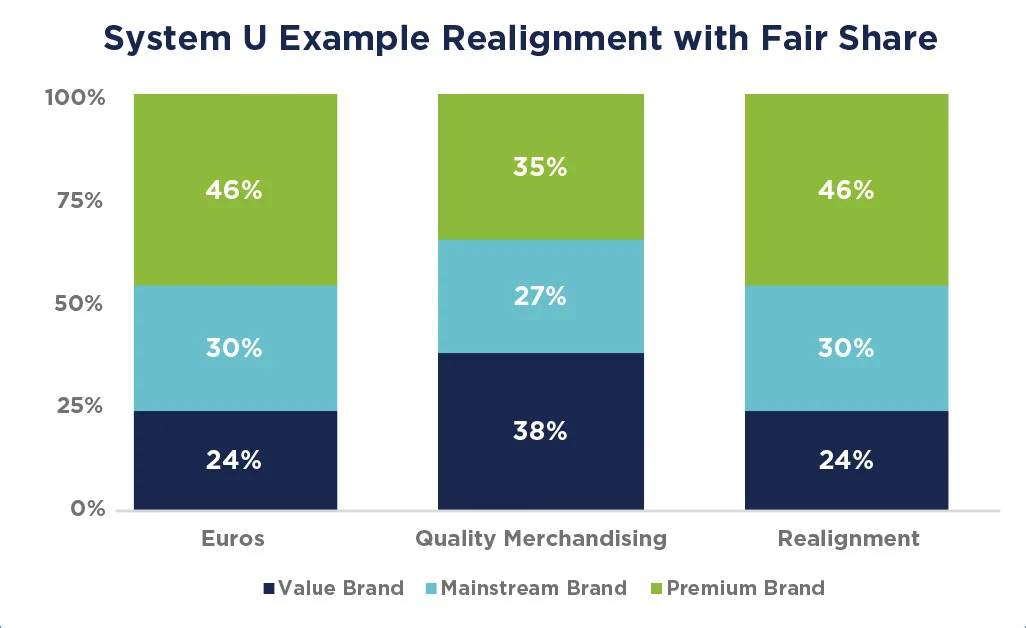

The commercial team leading the overall category management assessment wanted their contribution to the category to be better reflected in their access to merchandising events. But they needed to generate a “win-win” story for the retailers. Using the CIA® platform, Middlegame tested the reallocation of merchandising so that the SKUs of the premium and mainstream brands received a fair share of support based on their ability to deliver retailer euros. As part of addressing the “win-win”, CIA® displayed the simultaneous impact on the SKUs, the portfolio as a whole, and the total category for each retailer.

EXPECTATION ANALYSIS

It’s All the Numbers

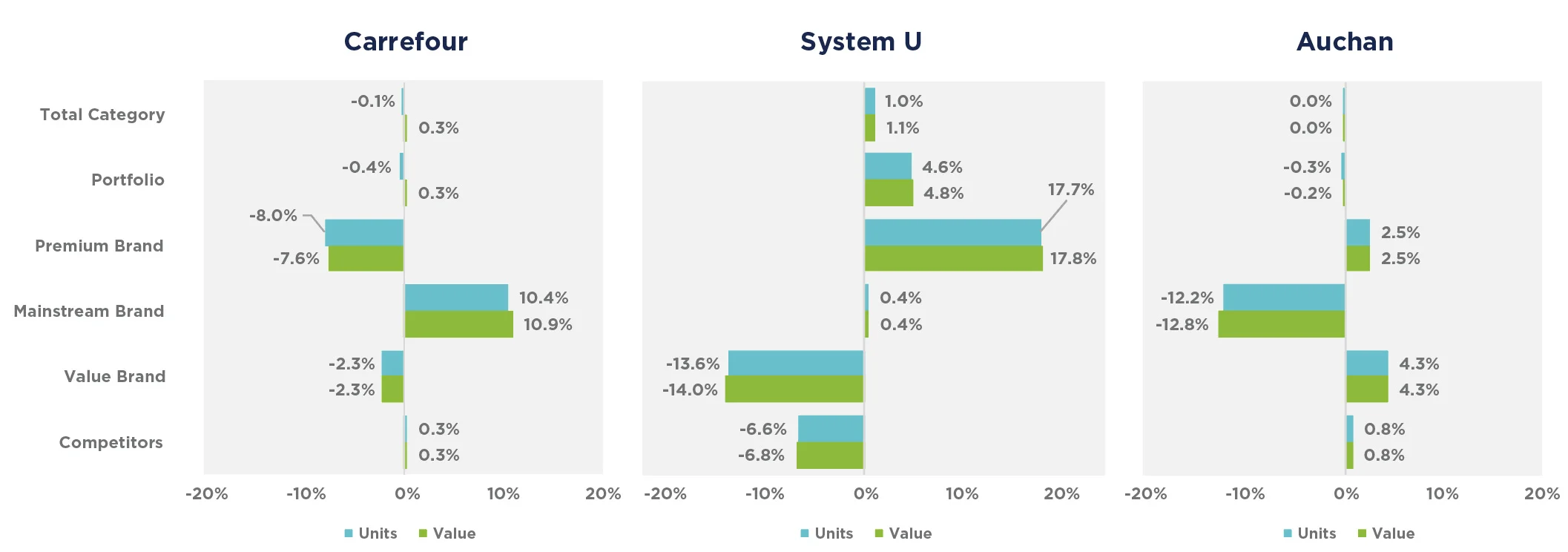

Realigning promotional support generated different expected outcomes across the retailers. System U presented the most opportunity given the under-representation of the premium brand SKUs. The result was a 4.6% gain in portfolio units and 4.8% gain in euros. At the same time, the category was expected to grow by 1.1% euros for the retailer. At Carrefour, the estimated outcome was less impactful, suggesting a portfolio increase of -0.4% for units and 0.3% for euros with no real category effect. The impact at Auchan was actually negative for the portfolio due to the attempt to refocus the value brand in the face of the stiff store brand presence.

CLIENT ACTIONS

One Size Would Not Fit All

Knowing that a one-size-fits-all strategy would not work across brands or retailers, the commercial team reduced the merchandising initiative to include only the premium brand at System U. The focus at Carrefour and Auchan focused on optimizing the assortment of SKUs offered, including reconsidering the value brand in this channel. However, concentrating on the impact of the category as a whole at System U persuaded the retailer to offer more quality merchandising to the premium brand. Although not category captain, the client was given the opportunity to help align the entire category promotion calendar using the CIA® scenario-planning tool.