Leading Toothpaste Brand Brightens View on Marketing Opportunities

LOCATION: China

When an emerging leader in China’s toothpaste market faced big decisions about product roll-out, media and marketing, Middlegame delivered detailed marketing and product options, predictive results and a strategy for protecting the brand against its competition while growing its market share.

SITUATION REVIEW

Looking for a Solution to Sink Their Teeth Into

Six years after its introduction in China, the client’s leading brand of toothpaste had closed the volume gap against its competitor, the then market leader. The majority of the client brand’s gains were at the expense of competitor brands. These gains were fueled by significant investments in advertising by the client, which were offset by the paste’s higher overall prices.

OPPORTUNITY ASSESSMENT

Brushing Up on Product and Marketing Options

In response to losing market share, the client’s competitor released a new “total” brand that had a tremendous impact on the category and offered a significant 24.5% price advantage over the client’s product. The client – one of the leading manufacturers of personal care and home care products in the world – deliberated about introducing a similar product in order to create a firewall to protect the brand from this competing product.

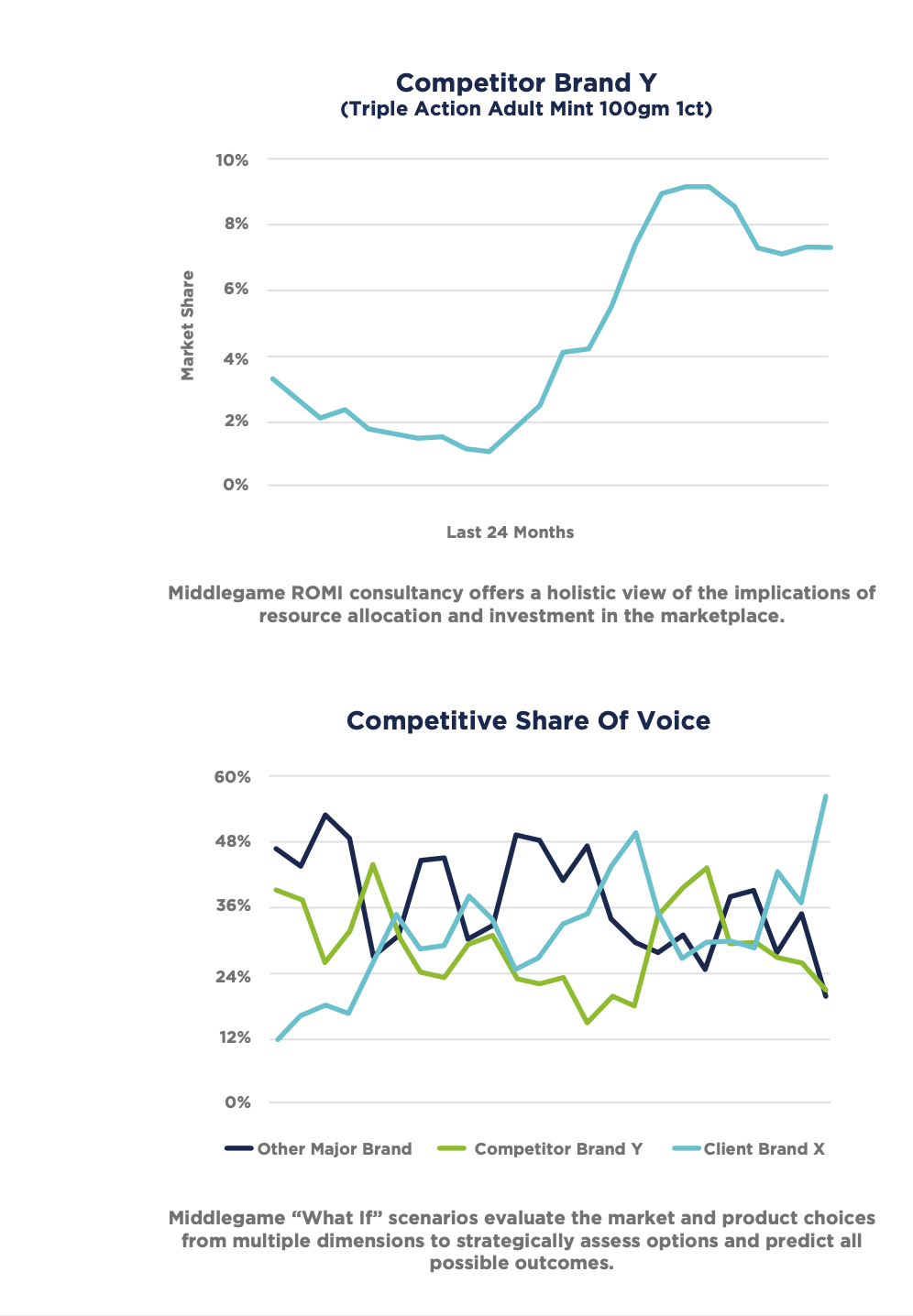

The competitor had traditionally been the recognized leader in advertising within the toothpaste category, but the client’s increased advertising had removed that advantage. Realizing that the competing toothpaste brand would not allow its influence in the advertising marketplace to decay, the client questioned what would happen if the competitor significantly increased its advertising spending.

SCENARIO DEFINITION

Was a Line Extension Z Solution the Competitor Brand Y Answer?

The brand team suggested testing a client product that aligned with the competitor’s US-based “complete” line. It was identical in every way, other than in name, to the competitor’s “total” brand in China and was similarly priced. In addition to evaluating the feasibility of a new product introduction, the client also had to consider how the competitor would respond to losing advertising dominance.

Middlegame evaluated the expected outcome if the competitor in China increased its advertising share of voice to be at parity with the client – which represented a 36% increase. If the competitor attempted to return to its previous level of advertising dominance from two years earlier, it would require a 62% increase in advertising spending.

EXPECTATION ANALYSIS

Clear Examination for an Informed Decision

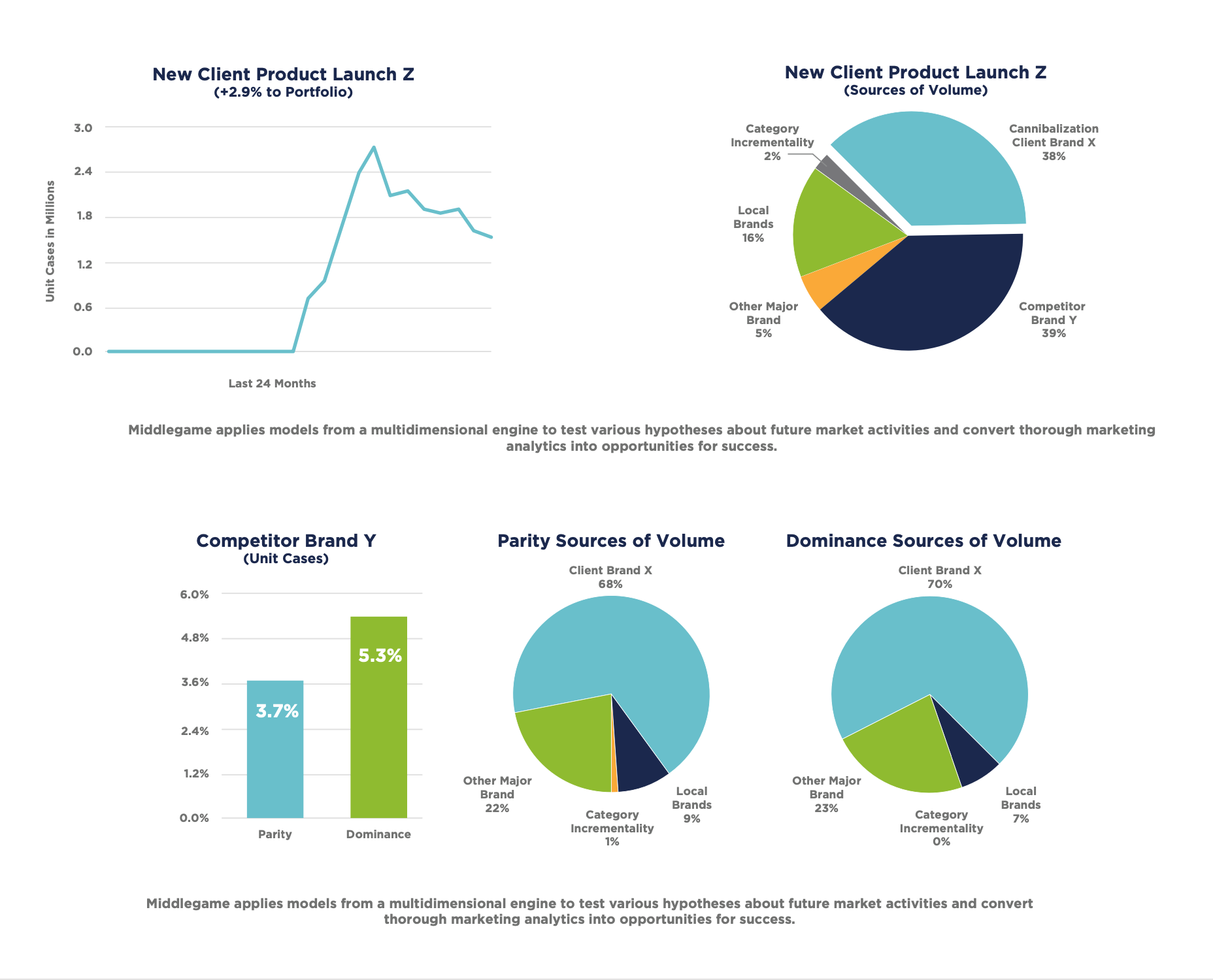

Middlegame’s analytics predicted that the client’s new “complete” toothpaste product would generate a quick build, but sales would soon become level. The new product would cannibalize sales from the client’s existing products in the market, but would still translate into a 2.9% increase for the brand portfolio.

However, the competitor’s advertising increase to achieve share of voice parity or return to a place of dominance in the advertising market would grow the competitor’s portfolio by 3.7% or 5.3% respectively. Proprietary CIA® analytic software clearly demonstrated that the Middlegame client had the most to lose in either situation.

CLIENT ACTIONS

Results to Smile About

Middlegame triangulated the CIA® simulation results with other studies for a holistic situation analysis. After considering the results, the client decided to launch a toothpaste line extension based on its “complete” toothpaste line with a 30.2% lower price. Using Middlegame’s insights, the client significantly increased advertising support for existing premium-tier toothpaste during the new product introduction to prevent shoppers from trading down. As a result, the client’s overall share increased with minimal cannibalization of the premium products in the brand portfolio.