Making a Clean Start in India

LOCATION: India

Clients often turn to Middlegame to help understand new distribution into new geographies or countries. Often this requires serious attention to Political, Environmental, Societal, and Technological (PEST) conditions. However, CIA® is also available when the strategy includes launching into new channels that are aligned with separate occasions and exposure to new shoppers

SITUATION REVIEW

Scouring the Market for Solutions

A multinational consumer goods corporation was in the process of expanding their position in India. Despite exclusively working with large retail chains, they had enjoyed more than a decade of growth due to a near-manic level of new supermarket openings across major markets. The client’s focus shifted toward acquiring distribution for their household cleaning brands in 12 million Kirana Stores representing the traditional trade. These shops enabled access to more than 85% of the national share of wallet. However, this was not a simple channel migration task.

OPPORTUNITY ASSESSMENT

A Fresh Start in New Spaces

The traditional trade for fast-moving consumer goods (FMCG) was worlds apart from modern trade in India. The small Kirana Stores were fragmented and disorganized. Purchases by shopkeepers usually included 5 to 10 individual pieces as opposed to several cases, like in supermarkets. If cleaning categories were carried, the entire stock rarely surpassed 50 total items, out of the reach of shoppers. With thousands of shops in each sales territory, time to make a case for adding product for each one was seriously limited. The initial pitch for adding products as well as access to prime visibility had to be a simple and compelling story.

SCENARIO DEFINITION

Formulated to Tackle the Toughest Issues

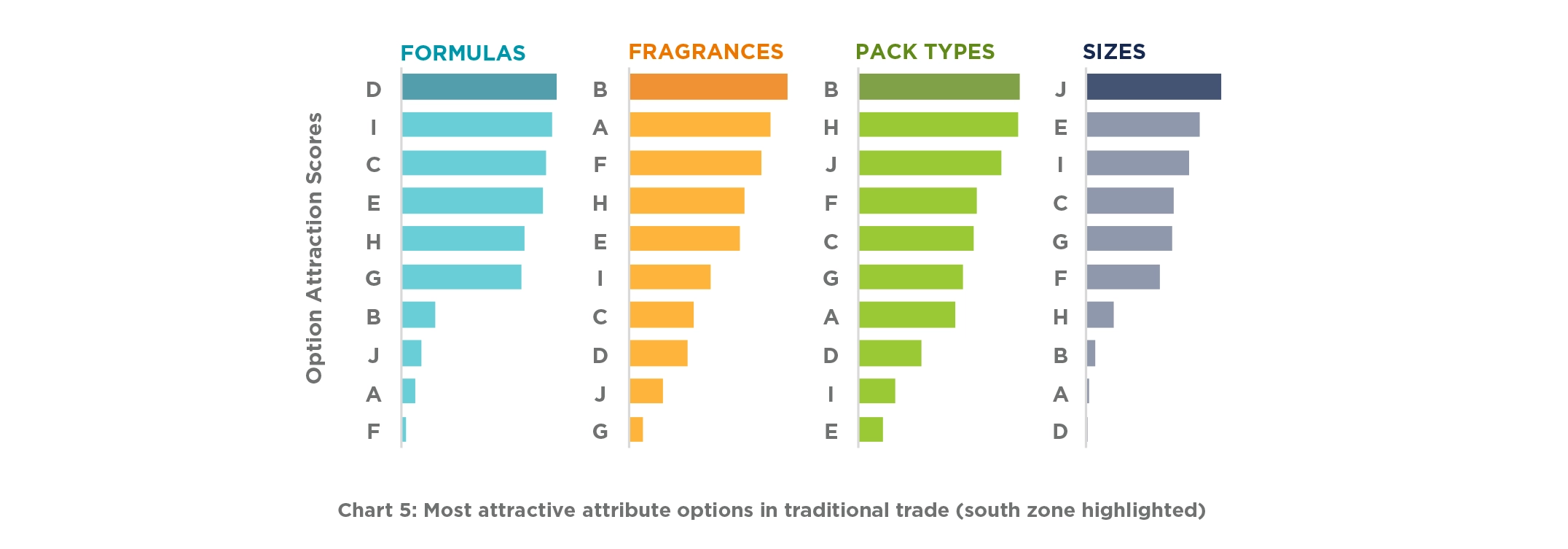

Middlegame’s CIA® platform was implemented for the existing bathroom, kitchen, and floor cleaning categories in traditional trade stores, using data collected by NielsenIQ. This modeling separated shopper attraction to the product attributes from pricing and promotional support as well as distribution levels. This approach allowed Middlegame to rank the existing options for formulation, fragrance, package type, and size, based on overall incrementality. Middlegame could then configure these into new products and “virtually test” their introduction to the existing shelf. The only product options that were not immediately available from the data were the attraction scores for the client’s brand names.

EXPECTATION ANALYSIS

Cleaning Solutions from the Ground Up

During prior due diligence, a brand favorability survey was conducted with shopkeepers. It included both their existing brands as well as those exclusively in the modern trade. Middlegame integrated these results with the existing CIA® attraction scores to impute the values for the client’s brands. After several simulations, the marketers identified 6 floor cleaning products with entry, frequency, and upsize roles for 2 brands. All the attributes were currently available in the modern trade, which minimized production changes. However, Middlegame’s analysis also uncovered the importance of special packs. Kirana shoppers were highly responsive to pre-priced packaging, so this was added to the product design.

CLIENT ACTIONS

A Solution that Sparkled with Opportunity

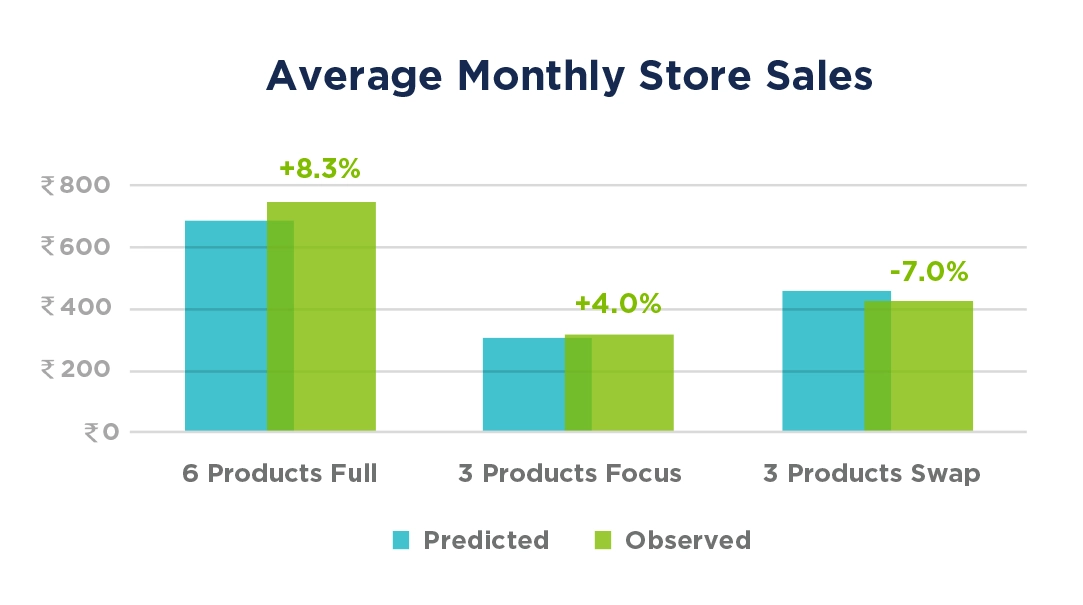

The marketing team presented the simulations as a “pre-search” exercise and were requested to draft next steps as a follow up. Since CIA® found the greatest opportunity in the South Zone, a market test of 400 stores for both Chennai and Hyderabad was performed. Virtual testing included scenarios that added all 6 products, focused on only just 3, or targeted the replacement of 3 competitor products. After 3 months, the test results were available with Middlegame projections within +/−10%, by condition. Senior management approved funding to immediately build distribution beyond the test. Within 18 months, traditional trade volume in the South Zone was reported to be more than 30% of total sales and expansion into additional regions has begun.