Growing Profits with the Right Price in the Hair Care Market

LOCATION: Great Britain

When a competing hair care product manufacturer encouraged retail discounts that decreased value for the entire category, particularly at the expense of a client’s premium brands, Middlegame intervened. Using CIA® proprietary software and proven analytical processes, Middlegame defused the competitor’s strategy – clearly demonstrating to the retail partner how the discount strategy was hindering profits for the retailer as well as for the client.

SITUATION REVIEW

From the Roots to the Tip of the Challenge

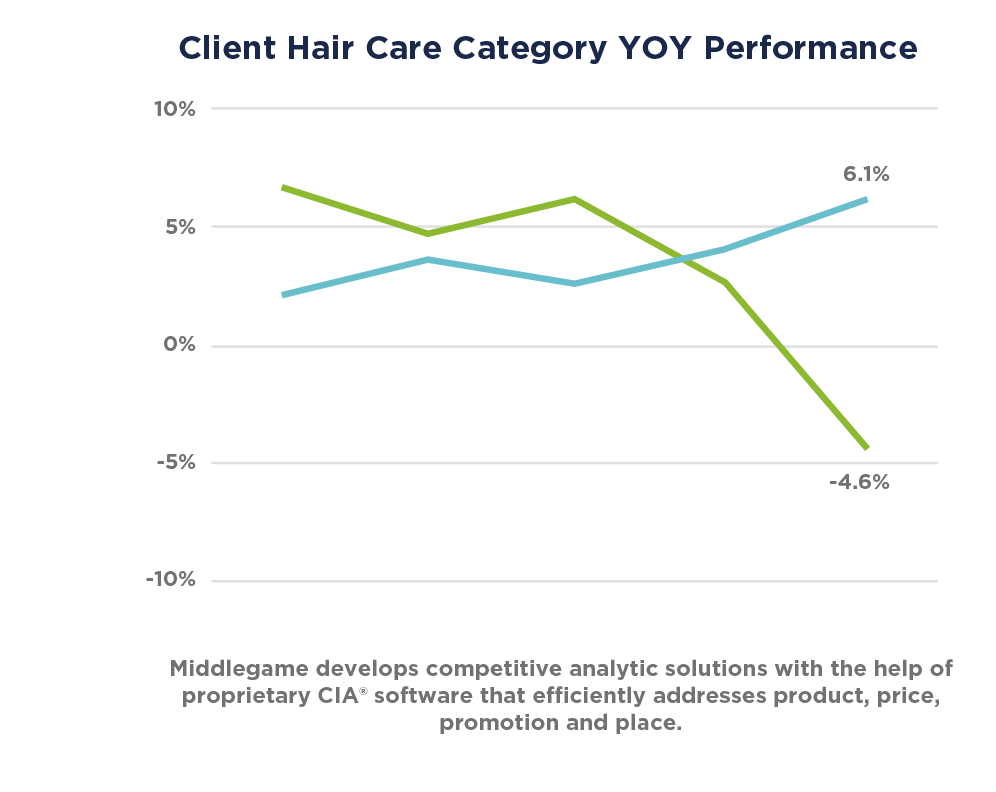

Volume in the client’s hair care category, including 5% shampoos and conditioners, was continuing to grow in Great Britain; however, overall value had declined by 4.6%. Middlegame’s client — a multinational manufacturer of everything from hair care to home care products — had a full portfolio of performance brands that were suffering the most with these declines. Historically, these performance hair care products were the greatest source of growth for the client’s retail partner, the second largest retailer in the world.

OPPORTUNITY ASSESSMENT

Heads Above the Competition

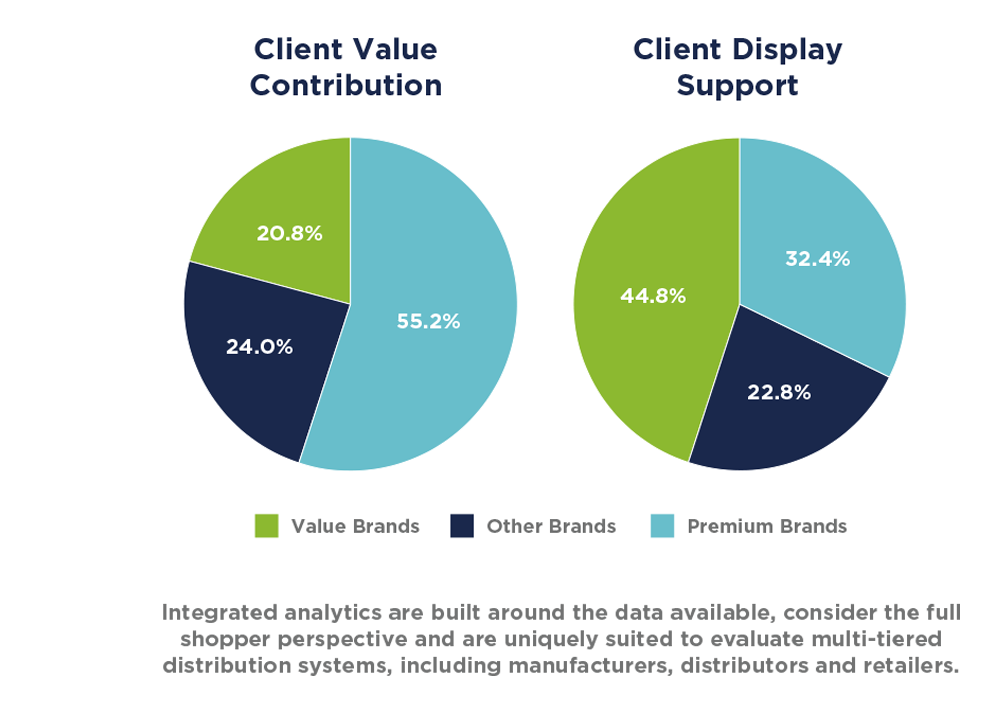

The hair care category was consistently losing value primarily because of increasing promotions and special deals that the retailer was offering on value brands. This was a strategy encouraged by a competing manufacturer of several value brands. As much as 69.2 % of the value brands, particularly the competitor’s brands, were being sold on deal. Although the value brands represented only approximately one-fifth (20.8%) of the value in the category, these brands were being allocated almost half (44.8%) of the extra, secondary retail locations designed to catch the consumer’s attention. Meanwhile, shoppers were overlooking the higher-margin premium brands, including professional and performance products. These premium brands were being eclipsed by the deep discount promotions and BOGO offers that the retailer was offering on the value brands.

SCENARIO DEFINITION

Trimming Out the Ineffective

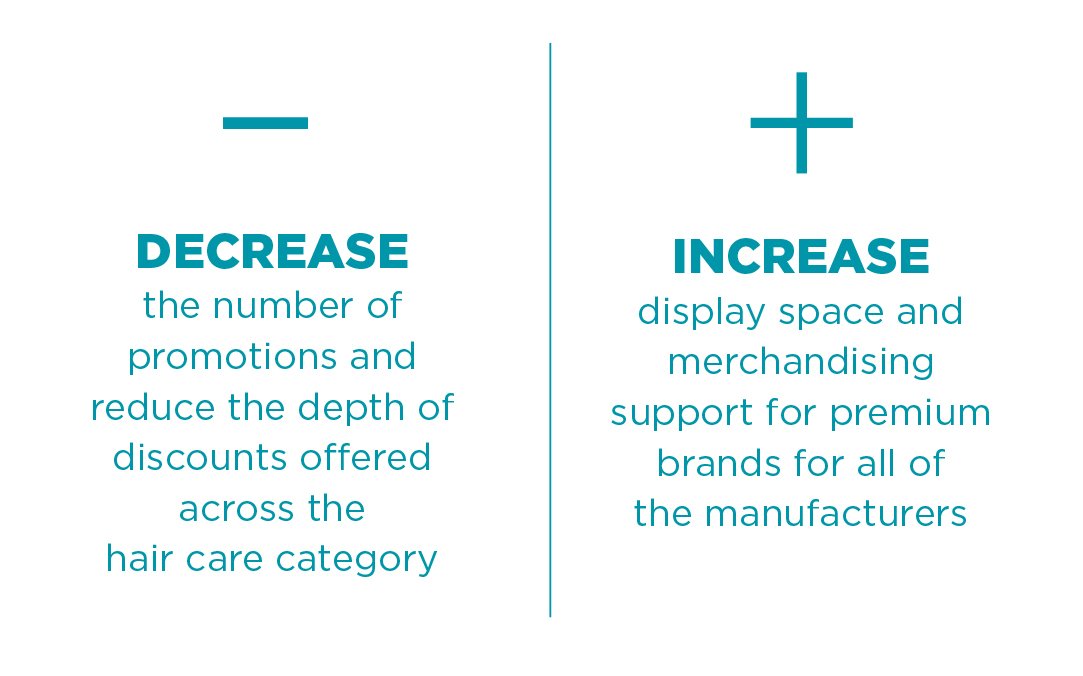

Jointly, Middlegame, the client and the promotional planning team for the international retailer evaluated multiple scenarios that would decrease the number of promotions and reduce the depth of discounts offered across the hair care category. In these scenarios, the value brands would maintain an Everyday-Low-Pricing (EDLP) strategy, while premium brands for all of the manufacturers would be allocated more display space and other merchandising support to increase sales.

EXPECTATION ANALYSIS

Styled for Success

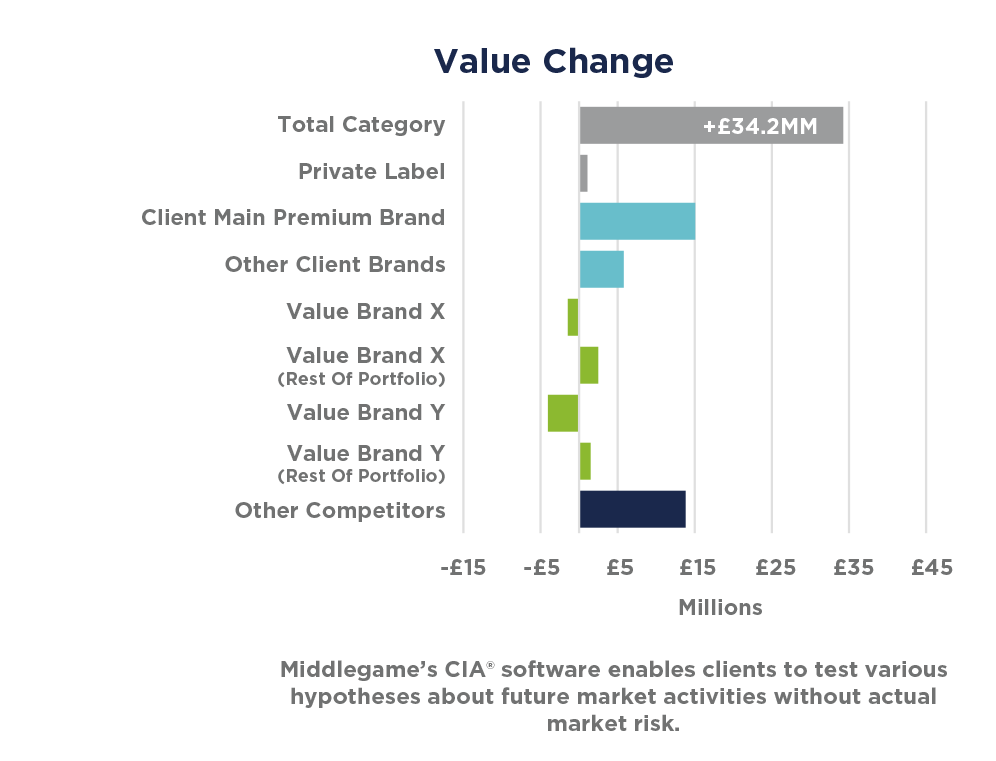

Limiting the use of promotions and providing more support for the higher-priced premium brands was expected to generate an additional £34.2MM value — and 2.3MM litres of incremental volume — to the hair care category per year. Middlegame’s client, in particular, anticipated an increase of £2.03MM, led by gains of £15.0MM for its leading premium hair care brand.

CLIENT ACTIONS

Letting Premium Brands Shine

Middlegame’s analytics convinced the retailer to reallocate display space, placing the emphasis on the premium brands rather. By changing the display, value growth for the hair care product category was revived. Subsequent promotional activities were prioritized to drive incremental sales for the retailer while still protecting both the equity and volume of the premium brands in the client’s portfolio. During the next planning cycle, the retailer shared that the changes made based on these recommendations had generated approximately an £8.0MM increase in margin for the retailer. The solution was a winning promotional style with layers of profits for all involved.