Determining the Health of an Acquisition

LOCATION: Australia

Most growth strategies focus on selling more products or services with greater frequency in markets familiar to the organization. Right or wrong, many companies believe that developing existing shoppers is less expensive the finding new ones. Often internal resources are deployed, but sometimes acquiring a competitor is a faster option for growth.

SITUATION REVIEW

The Taste of a New Direction

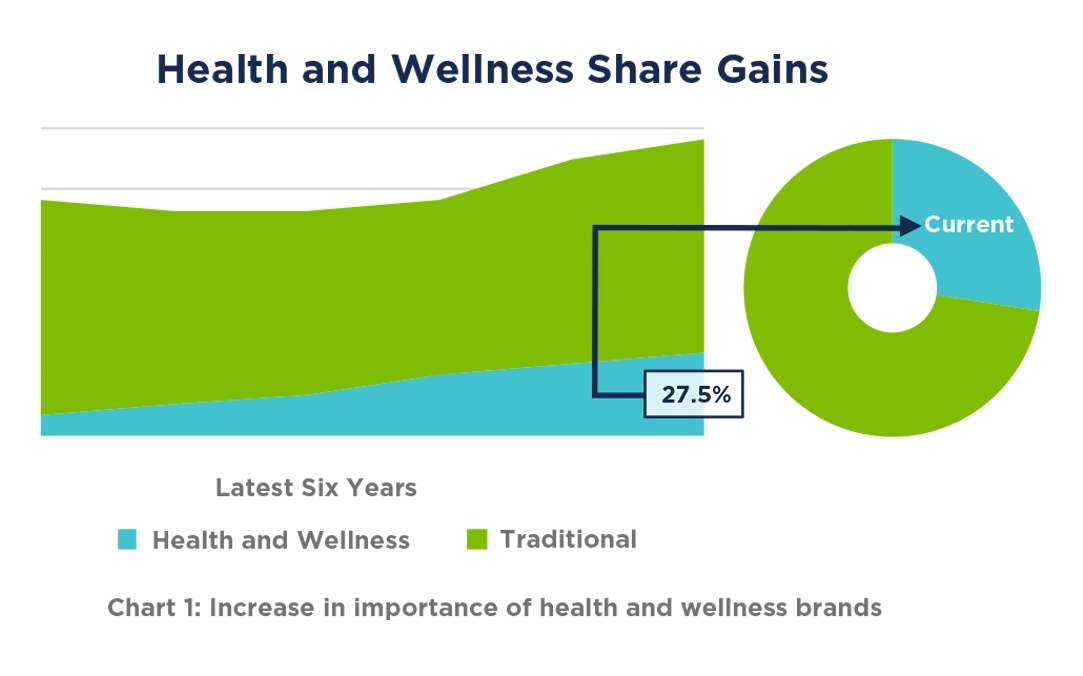

A well-established snack company was evaluating opportunities for growth but was intrigued with the presence of new entrants that dominated the “health and wellness” segment of the category. Senior management quickly targeted one of these up-and-coming firms for acquisition and requested that the finance team establish a valuation. To better understand exactly what they would be buying, the client hired Middlegame to explore a more “shopper-based” evaluation of brand equity for the target acquisition.

OPPORTUNITY ASSESSMENT

The Ingredients for Healthy Success

A brief discussion with the client’s finance manager revealed that the primary issue was the inability to disentangle the value of the brand name from the price-driven incentives that the client would need to continue to provide after the transaction finalized. The client knew that the brand name improved those promotions, but nobody had quantified this for the valuation. The use of retail tracking data to explain the value of a brand name as well as the differential effectiveness of the brand’s marketing made CIA® an ideal tool to address the problem.

SCENARIO DEFINITION

Food for Thought

Middlegame worked with the marketing team worked to better define the retail environment. Although major players like Coles and Woolworths professed to use an everyday low price (EDLP) format, they displayed more of a “hybrid-EDLP” pricing strategy. Therefore, Middlegame could assign the typical EDLP versus high-low pricing (HILO) format to different stores. The CIA® platform justified the segmentation by revealing that the outlets defined as HILO formats had very different brand equity assessments than those that were predominantly EDLP.

EXPECTATION ANALYSIS

Crunching the Numbers

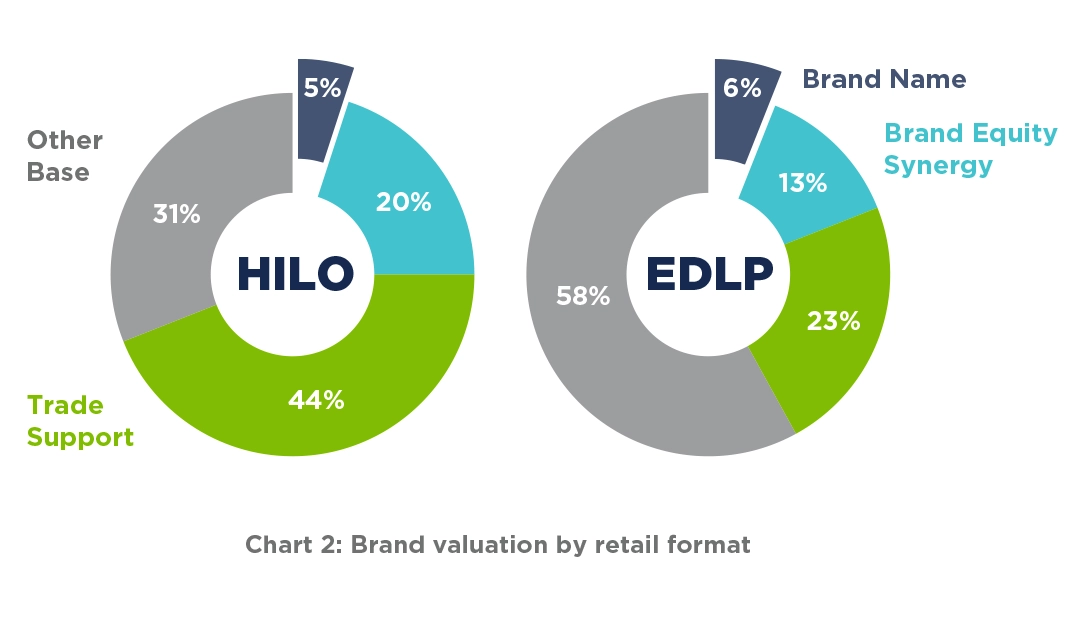

The results of Middlegame’s analysis demonstrated that the base price for fast-moving consumer goods (FMCG) was ambiguous in HILO due to heavy trade support, but brand equity played a significant role in these stores and represented 45% of what would be considered base sales (5% + 20%) divided by (100% – 44%).

On the other hand, EDLP was far more “base sales driven,” but was less dependent on brand equity. In this case it was 25% of base: (6% + 13%) divided by (100% – 23%). Therefore, EDLP stores were far more dependent on the everyday or base price as opposed to the brand name. Unfortunately, EDLP stores represented 73% of the current volume for the brand.

CLIENT ACTIONS

A Well-Informed, Healthy and Satisfying Snacking Solution

Middlegame was able to deliver the facts to the client’s finance team. Middlegame’s detailed analysis provided the client with accurate and complete information that helped define whether this acquisition was a strong business opportunity or an acquisition to avoid. Based on the information, the client has chosen to extend an existing brand in their portfolio. The new line focuses on health and wellness products, starting with a whole grain offering.