We often refer the book Marketing Metrics: The Manager’s Guide to Measuring Marketing Performance. I sent a used copy to a client after highlighting several of the Chapter Seven elements on pricing. The book is easily the best source for marketers wanting to understand how all the metrics in our discipline are defined, constructed, and used. The focus is on what Simon Sinek says are the how and what of marketing metrics. To help understand the very important why of marketing metrics, a recent report, by Ofer Mintz of Louisiana State University and his colleagues, was released by the Marketing Science Institute (MSI). The report collected over 4,000 marketing decisions from 16 countries. It represents both developed as well as emerging countries—accounting for over 80 percent of the world GDP.

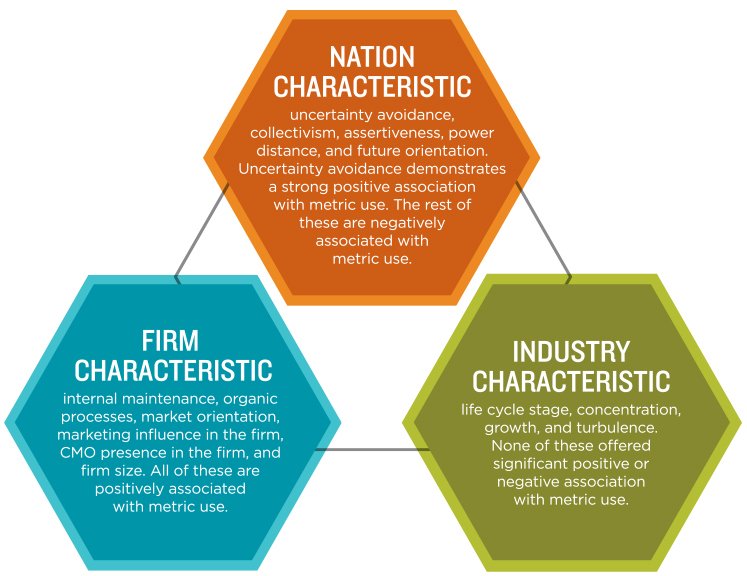

Subsequent analysis of all this data revealed three key dimensions of decision-making that they organized in a hierarchy of Nation, Industry, and Firm characteristics. The important drivers of metric use were found to be the following:

Uncertainty avoidance was obviously a big boost for us since we constantly talk about scenario-planning to minimize the risk of future decisions. But, the lack of stickiness with industry characteristics was alarming since these tend to align with our “wide-angle view” concept and the shopper perspective. Given our focus on emerging markets at Middlegame, we were very interested in the results. We wanted to see whether there were significant differences in the reason for metric usage in these kinds of economies versus the developed markets. Fortunately, the industry characteristics of concentration, growth, and turbulence rose further to the top in determining marketing metric use.

We are probably interpreting the study a somewhat different than others. Our goal is to use the findings to customize our messages for prospective clients based on nation, industry, and firm characteristics. However, I think clients whose roles are at global headquarters will see this as an opportunity to organize their strategies to drive the application of marketing metrics downstream to local markets. We understood this when I was at The Coca-Cola Company in the nineties. But, there was no playbook like this one that could align my thinking when communicating the adoption of new measurement like transferred demand. Regardless, I recommend looking at the whole document. It is free to both MSI members as well as non-members. You simply need to register to gain access.

Middlegame is the only ROMI consultancy of its kind that offers a holistic view of the implications of resource allocation and investment in the marketplace. Our approach to scenario-planning differs from other marketing analytics providers by addressing the anticipated outcome for every SKU (your portfolio and your competitors’) in every channel. Similar to the pieces in chess, each stakeholder can now evaluate the trade-offs of potential choices and collectively apply them to create win-win results.