Many companies are making significant strides in leveraging massive amounts of data to drive growth and reduce cost. But it’s not uncommon for organizations to struggle with using their data to make the smartest possible decisions. We constantly hear frustrations with “too much data, too few insights”, “too many independent streams of data”, or “too much analysis explaining the past.”

Many companies are making significant strides in leveraging massive amounts of data to drive growth and reduce cost. But it’s not uncommon for organizations to struggle with using their data to make the smartest possible decisions. We constantly hear frustrations with “too much data, too few insights”, “too many independent streams of data”, or “too much analysis explaining the past.”

THE DRAWBACKS OF DESCRIPTIVE ANALYTICS

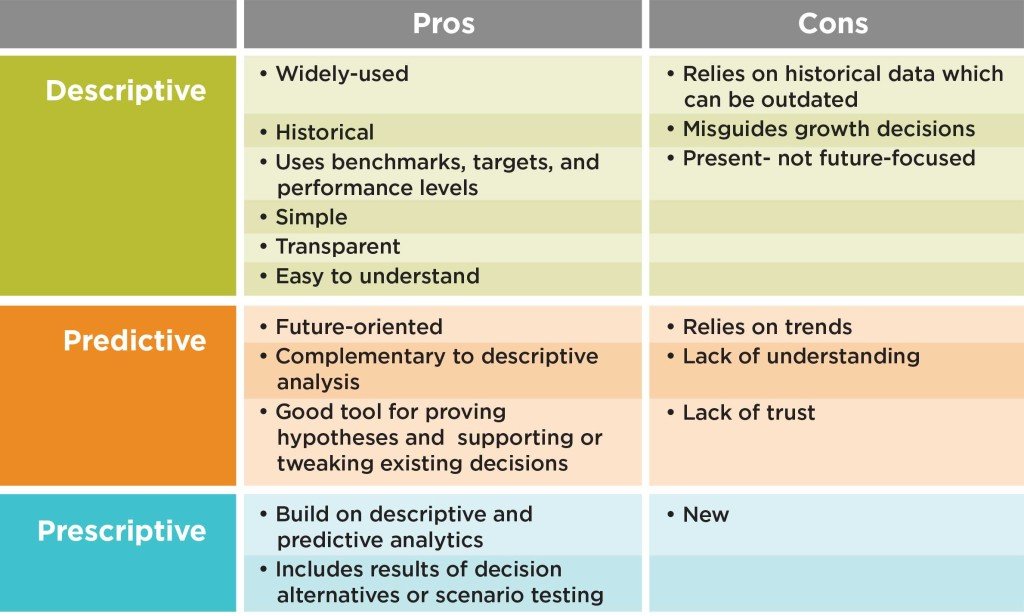

An important reason for these challenges is that most big data analytics in the Consumer Packaged Goods (CPG) industry are still descriptive by nature. Descriptive analytics tend to be a scorecard for the present situation against relevant benchmarks and targets which are further informed by historical data and minimal levels of manipulation. Such analyses have a natural appeal since they are simple, transparent and can be easily understood by all stakeholders. Descriptive analyses also reveal where performance is strong and where it is weak as well as where growth or cost efficiencies may lay.

As appealing as descriptive data may be, it is also the biggest source of misguided growth decisions due to its illusive nature: any descriptive analysis reflects a past that will never return. The present is at best a bleak shadow of the future, particularly in developing markets with high levels of volatility. Moreover, descriptive analyses focus on problems of the present and take attention away from opportunities ahead. Descriptive analysis alone therefore tends to offer a poor basis for making important marketing decisions. Even more concerning is that as much as

As appealing as descriptive data may be, it is also the biggest source of misguided growth decisions due to its illusive nature: any descriptive analysis reflects a past that will never return. The present is at best a bleak shadow of the future, particularly in developing markets with high levels of volatility. Moreover, descriptive analyses focus on problems of the present and take attention away from opportunities ahead. Descriptive analysis alone therefore tends to offer a poor basis for making important marketing decisions. Even more concerning is that as much as

80% of all business planning is

based on this type of information.

THE PARAMETERS OF PREDICTIVE ANALYTICS

In recent years there has been an emphasis on the promise of more precise predictions by leveraging increases in available market data. Predictive analytics is future-oriented and focused on describing what will occur based on trends and other expectations. The deployment of predictive analytics in CPG has been slower than expected given statistical modeling of market data became a mainstream activity among leading manufacturers nearly 20 years ago. Arguably, the use of predictive analytics has been inhibited by lack of understanding and trust among decision makers in the power of statistical models, difficulties in translating model results into non-technical terms and extended project timelines and lack of relevant data. While predictive analytics are used widely it is still often considered complementary to descriptive analytics and as a tool for proving hypotheses and supporting or tweaking existing decisions.

The historical emphasis of descriptive analytics and the limited use of predictive analytics come at a high cost: weak decision-making based on insufficient data and too much reliance on human ability to fill in the blanks. With vast amounts of data available, a key question for commercial decision makers is: What do you want this data to do for you? In most cases, the answer is to select or support a course of action.

WHAT IF COMMERCIAL DECISION ALTERNATIVES COULD BE TESTED IN THEIR ENTIRETY, DELIVERING OBJECTIVE, RELIABLE AND CONCLUSIVE ANSWERS FOR EACH ALTERNATIVE? THIS IS THE INTENT OF PRESCRIPTIVE ANALYTICS.

Prescriptive analytics build on descriptive and predictive analytics while adding a critical component that helps overcome limitations for business planning: prescriptive analytics deliver testing of well-defined decision alternatives in the form of scenarios. It shifts focus away from findings and insights based on lift coefficients, beta values and other analytics jargon and toward commercial options that everyone can understand. While similar to simple descriptive analyses, prescriptive analytics provides a focus on the future within the context of decisions to be made.

The main objective of prescriptive analytics is to prioritize decision alternatives and therefore extend beyond a description of the past or a prediction of future trends. It suggests how the product portfolio, individual SKUs, value-chain partners, the product category and even the competition will be impacted by each decision. It illustrates the implications of each decision option in commercial terms, not analytical or statistical ones.

The main objective of prescriptive analytics is to prioritize decision alternatives and therefore extend beyond a description of the past or a prediction of future trends. It suggests how the product portfolio, individual SKUs, value-chain partners, the product category and even the competition will be impacted by each decision. It illustrates the implications of each decision option in commercial terms, not analytical or statistical ones.

Prescriptive analytics tells us what will happen if an “event” is introduced to the market place. An event could constitute a new price point, a change in merchandizing, promotions, assortment or any combination across the marketing mix including the competitors’. Using retail tracking data and media data for prescriptive modeling and simulations, we can determine the probable future outcome of a decision or the impact of a likely external event.

By framing business options within the rich capabilities of prescriptive analytics, decision makers are better able to leverage the true potential of advanced analytics, enabling them to optimize growth decisions and mitigate marketplace risks. It is therefore important to ensure that the type of analysis performed is aligned with this need and is completely objective. At a strategic level, these options may range from alternative marketing plans and pricing plans to assortment changes. From a more tactical perspective, decisions options may range from better anticipation of competitive moves and price adjustments to a few SKUs to exploring alternative ways to mitigate risks from external events such as a strike or unfavorable weather.

Ultimately, by evaluating outcomes from alternative decision options, companies that embrace prescriptive analytics are better prepared to manage external developments and make transformative decisions with greater confidence than ever before.